Loading

Get Mini 1003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mini 1003 online

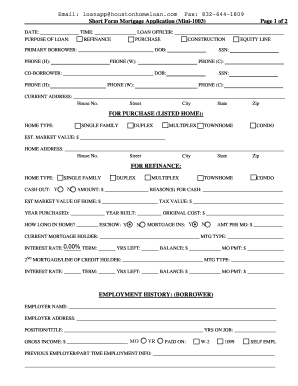

The Mini 1003 is a crucial document for individuals seeking a mortgage, whether for purchasing a new home, refinancing, or obtaining a line of credit. This guide provides step-by-step instructions to help users navigate the online completion of this form confidently.

Follow the steps to complete the Mini 1003 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the date and time at the top of the form. This section will help track when you completed the application.

- Enter the loan officer's name responsible for handling your application.

- Indicate the purpose of the loan by selecting one from the options: refinance, purchase, construction, or equity line.

- For borrowers, fill in your personal information, including your name, date of birth, Social Security number, and contact numbers.

- If there is a co-borrower, repeat the same steps for them by filling out their personal details in the designated section.

- Ensure both parties have their information accurately recorded.

- Provide your current address, making sure to include all relevant details such as house number, street, city, state, and zip code.

- If the application is for a purchase, complete the home type and estimated market value sections.

- For refinance applications, indicate the home type. Fill in whether you are cashing out and the corresponding amount.

- List the reasons for the cash out if applicable.

- Complete your employment history by listing your employer's name, address, position, years on the job, and gross income.

- Provide information on how you are compensated, whether through W-2, 1099, or self-employment.

- Fill in the revolving debt and monthly obligations, including if you pay child support or alimony and the relevant monthly amounts.

- Include whether real estate taxes are applicable and provide necessary amounts if known.

- Complete the assets section by listing your cash in bank accounts, investments, and any property you own.

- Be thorough in detailing your financial situation to facilitate the processing of your application.

- Review all filled sections for accuracy before finalizing your application. After ensuring everything is correct, you can save changes, download, print, or share the form as needed.

Complete your Mini 1003 online today for a smooth and efficient mortgage application process.

The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property. Form 1003 is typically completed twice in the mortgage process: once during the initial application, and again at closing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.