Loading

Get Ca Sbrpa Form 22.0 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA SBRPA Form 22.0 online

Filling out the CA SBRPA Form 22.0 online can seem intimidating, but this guide will offer you clear and straightforward instructions. By following these steps, you can complete the form confidently and efficiently.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it in the designated online editor.

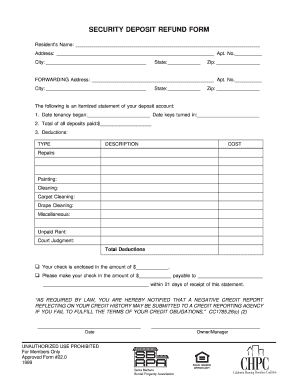

- Begin by entering the resident’s name in the appropriate field, ensuring accuracy and clarity.

- Fill in the address details, including the apartment number, city, state, and zip code for the current residence.

- Next, provide the forwarding address where you would like correspondence to be sent. Include any specific apartment number, city, state, and zip code.

- Record the date when the tenancy began and the date when the keys were returned in the designated fields.

- Indicate the total amount of all deposits paid in the corresponding field.

- List any deductions in the provided table. For each item type, describe the reason for the deduction and enter the associated costs. Be sure to check off any completed deductions.

- At the end of the deductions section, ensure the total deductions are calculated accurately.

- Indicate the amount of the enclosed check, if applicable, and specify the name to which the check should be made payable.

- Review the notification regarding credit reporting, ensuring to familiarize yourself with the obligations stated.

- Lastly, date the form and include the name of the owner or manager responsible.

- After filling out the form, save your changes. You can then download, print, or share the completed form as needed.

Start completing your CA SBRPA Form 22.0 online today for a smooth processing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Whether you need to file a California state tax return depends on various factors such as your income level, filing status, and age. Generally, if you earn income in California, you may need to file a return. It is also essential to consider any specific requirements for forms like the CA SBRPA Form 22.0, as they may apply to certain situations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.