Loading

Get What Is A Nys File Number On Form Ct 3 S

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is A Nys File Number On Form Ct 3 S online

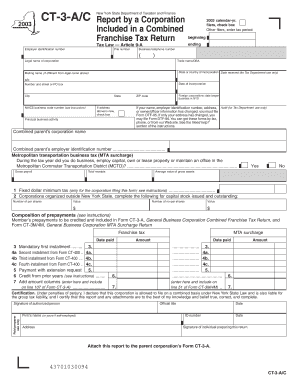

Understanding how to complete the What Is A Nys File Number On Form Ct 3 S is crucial for ensuring compliance with New York State tax regulations. This guide provides a comprehensive overview of the form, detailing each section and field to help users navigate the process smoothly.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the legal name of the corporation in the designated field. Ensure accurate spelling, as this reflects the official registration.

- Input the trade name or DBA (Doing Business As) if applicable. This is vital for identifying the business's public operating name.

- Provide the state or country of incorporation along with the date of incorporation. This information confirms the legal foundation of the corporation.

- Fill out the mailing address, if it differs from the legal name address, ensuring all details are correct, including the ZIP code.

- Enter the NAICS business code number, which identifies the nature of the business activities. This code is typically found on the federal tax return.

- Indicate whether the address listed is new by checking the appropriate box. This step is critical if your business has relocated recently.

- For foreign corporations, specify the date the business began in New York State. This information is essential for tax liability determination.

- Complete the sections for gross payroll, total receipts, and average value of gross assets. If there are none, enter ‘0’ to correctly report tax information.

- Fill in the composition of prepayments and other tax filings as instructed. This section may require calculations based on prior tax credits.

- Affix the signature of an authorized person and include their official title. This validation is necessary for the filing's legal standing.

- After completing all relevant sections, you can save changes, download, print, or share the form as needed.

Complete your tax forms online for efficiency and compliance.

Mail returns to: NYS Corporation Tax, Processing Unit, PO Box 1909, Albany NY 12201-1909. If you use a delivery service other than the U.S. Postal Service, see Private delivery services below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.