Loading

Get Provider Tax Identification Reporting Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Provider Tax Identification Reporting Form online

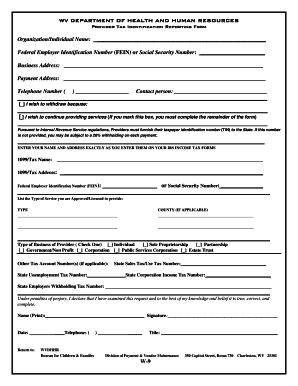

Completing the Provider Tax Identification Reporting Form online is an essential step for providers to fulfill their tax obligations with the state. This guide will provide you with a clear and structured approach to filling out the necessary information accurately and efficiently.

Follow the steps to complete your form correctly.

- Press the ‘Get Form’ button to access the Provider Tax Identification Reporting Form and open it for editing.

- Begin filling out the form by entering your organization's or individual name in the designated field.

- Provide your Federal Employer Identification Number (FEIN) or Social Security Number in the required section. Ensure this is accurate as it is critical for tax reporting.

- Fill in your business address and payment address. Make sure to complete all fields fully to avoid any processing issues.

- Enter your telephone number and the name of your contact person for any follow-up inquiries.

- Indicate your intention by checking the appropriate box: either to withdraw from services or to continue providing services. Only complete the remainder of the form if you choose to continue.

- Enter your 1099/tax name and address exactly as listed on your IRS income tax forms to ensure consistency.

- List the type of services you are approved or licensed to provide, along with the applicable county if necessary.

- Select your type of business by checking one of the provided options (e.g., individual, sole proprietorship, partnership, etc.).

- If applicable, fill in any other tax account numbers such as state unemployment tax number or state sales/use tax number.

- Review the declaration section. By signing, you confirm that the information provided is true and complete to the best of your knowledge.

- Enter your name, date, and title in the designated fields before signing the form.

- Finally, choose to save your changes, download the form, print a copy for your records, or share it as needed.

Complete your Provider Tax Identification Reporting Form online now to ensure compliance and facilitate your service provision.

W-4 forms serve as instructions that an employer uses to withhold taxes from their staff's paycheck, and a W-2 is a report of those withholdings at the end of the year. W-4s are essential for correct payroll processing and accurate tax reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.