Loading

Get 1099n

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1099n online

This guide provides clear, step-by-step instructions on how to fill out the 1099n form online. It is essential for individuals and businesses to understand the requirements for reporting compensation accurately.

Follow the steps to complete your 1099n form online.

- Click ‘Get Form’ button to obtain the 1099n form and open it in the editor.

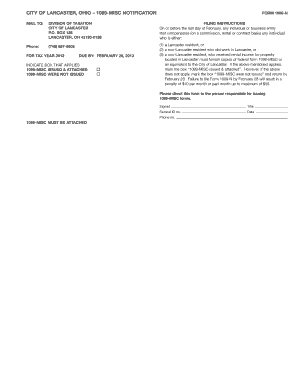

- Indicate whether you have issued a 1099-MISC form by marking the appropriate box: '1099-MISC issued & attached' or '1099-MISC were not issued'. This decision is based on whether you compensated a Lancaster resident, a non-resident who worked in Lancaster, or a non-resident who received rental income for property located in Lancaster.

- Complete the section for the person responsible for issuing the 1099-MISC forms. This includes entering their name, title, and federal ID number.

- Enter the date and phone number of the person responsible for the 1099-MISC issuance in the designated fields.

- Ensure that the 1099-MISC form is attached if you marked the first option. Once confirmed, check all entries for accuracy.

- Save your changes, and then you can download, print, or share the completed form as needed.

Complete your documents online today to ensure timely filing and compliance.

Payments to corporations Any payments made to corporations are exempted from sending form 1099-MISC or any other types. The exemption also includes payments to LLCs and partnerships that choose to be treated as S or C corporations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.