Loading

Get Fl-probate-001 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL-PROBATE-001 online

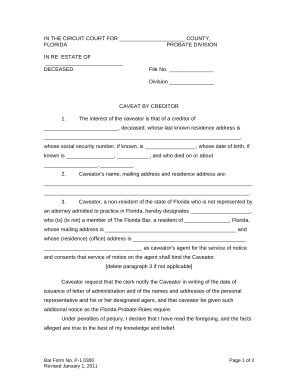

Filling out the FL-PROBATE-001 form is an essential step for creditors involved in probate cases. This guide will help you navigate the online process effectively and ensure that you complete the form correctly.

Follow the steps to successfully complete the FL-PROBATE-001 form online.

- Press the ‘Get Form’ button to access the FL-PROBATE-001 form and open it in your selected browser.

- Begin by entering the county name where the probate case is being filed in the designated field at the top of the form. This ensures that your submission is directed to the correct jurisdiction.

- Fill in the name of the deceased individual and their last known residence address in the appropriate spaces. If available, also provide their social security number and date of birth.

- Next, provide your details as the caveator, including your name, mailing address, and residence address. Make sure this information is accurate as it will be used for further correspondence.

- If applicable, designate an agent for service of notice. Include their name, residency status, and their address. If you do not have an agent, you can skip this section.

- Review your entries to ensure all information is correct. At the bottom of the form, confirm your declaration of truthfulness by signing and dating the document.

- Finally, once all fields are completed and reviewed, save your changes, download the form as a PDF, and print it for your records. You may also share the completed form as needed.

Start filling out the FL-PROBATE-001 form online today to manage your probate notices efficiently.

Filing for probate – 10-day deadline This specifies that the individual in possession of the deceased's last will and testament must file for probate within 10 days from the date of death of the deceased in the same county where the deceased died. The size of the estate to be probated does not affect these ten days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.