Loading

Get Form 15j

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15j online

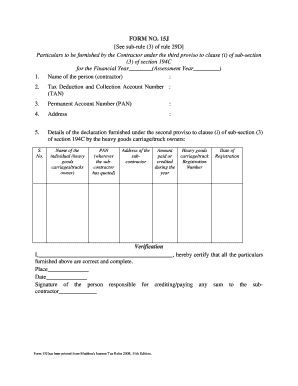

Filling out Form 15j is essential for contractors to furnish necessary particulars as per tax regulations. This guide will help you navigate the online process seamlessly, ensuring that you complete the form accurately and efficiently.

Follow the steps to successfully complete Form 15j online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the person (contractor) in the designated field.

- Provide your Tax Deduction and Collection Account Number (TAN) in the appropriate section.

- Fill in your Permanent Account Number (PAN) accurately.

- Input your address in the section provided.

- In the details section for declarations, list the heavy goods carriage or truck owners. For each entry, include the S.No, name of the individual, PAN (if the subcontractor has quoted), address of the subcontractor, amount paid or credited during the year, heavy goods carriage/truck registration number, and date of registration.

- In the verification section, enter your name in the designated area, certifying that all particulars furnished are correct and complete.

- Specify the place and date where you're filling out the form.

- Complete the form by signing in the section for the person responsible for crediting or paying any sum to the subcontractor.

- Once all sections are filled out, save your changes, and choose to download, print, or share the completed form as needed.

Complete your documents online effortlessly and ensure compliance with tax regulations.

As per the Income Tax Act, Form 27C is a declaration form for non-deduction of Tax Collected at Source (TCS) by the buyer of goods to its seller. Rules state that the seller of goods needs to collect taxes from the buyer. However, if the buyer is not liable to pay TCS, he/she can file Form 27C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.