Loading

Get Ie Form Cg1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form CG1 online

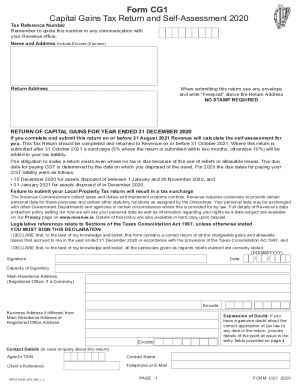

The IE Form CG1 is essential for reporting capital gains tax and ensuring compliance with revenue obligations. This guide provides a clear and supportive walkthrough for completing the form online, making the process manageable for all users.

Follow the steps to fill out the IE Form CG1 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your Tax Reference Number in the designated field. This number is important for any future communication with the revenue office.

- Fill in your name and address, including your Eircode if known. Ensure all information is accurate to avoid issues.

- Complete the section titled 'RETURN OF CAPITAL GAINS FOR YEAR ENDED 31 DECEMBER 2020.' You must submit this return by 31 October 2021 to avoid surcharges.

- Provide details of any gains by filling in the 'Description of Assets' section. This includes categorizing assets such as shares, securities, land, and other properties.

- Indicate if any disposals occurred between connected parties and if the original acquisitions were not at arm's length.

- Claim any reliefs applicable by filling out the relevant sections for both yourself and your spouse or civil partner where applicable.

- Complete the self-assessment by providing necessary figures regarding chargeable gains and any deductions, reliefs, or allowances.

- Ensure that you sign and date the declaration, confirming the accuracy of the information provided.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your documents online to ensure compliance and ease of submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

That means any gain from selling your primary residence overseas is usually tax-free, as long as you meet the occupancy requirements and your gain is below these thresholds: $500,000 – if you're married filing jointly. $250,000 – if you use any other filing status.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.