Loading

Get Ny Db-135 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DB-135 online

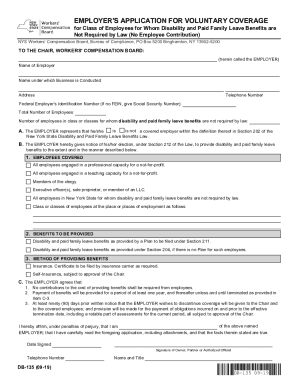

The NY DB-135 is an essential form for employers seeking voluntary coverage for disability and paid family leave benefits in New York. This guide provides step-by-step instructions on how to complete the form online efficiently, ensuring compliance with state laws.

Follow the steps to complete the NY DB-135 form online.

- Press the ‘Get Form’ button to access the NY DB-135 form and launch it in your preferred online editor.

- Enter the name of the employer in the designated field.

- Fill in the name under which the business is conducted along with a contact telephone number.

- Provide the complete address of the employer.

- Input the Federal Employer's Identification Number or Social Security Number if no FEIN is available.

- State the total number of employees in the specified field.

- Indicate the number of employees in the class or classes for whom disability and paid family leave benefits are not required by law.

- Complete Section A by selecting whether the employer is a covered employer within the definition in Section 202 of the New York State Disability and Paid Family Leave Benefits Law.

- In Section B, provide specifics of the election to provide benefits: list the employees covered, specify the benefits to be provided, and indicate the method of providing these benefits.

- Confirm in Section C that no contributions will be required from employees and provide additional necessary details related to the coverage.

- Affirm the truthfulness of the application by signing and dating the form, then entering the name and title of the individual signing.

- Once all fields have been completed, save your changes, download, print, or share the completed form as needed.

Complete your NY DB-135 form online today to ensure compliance and secure the necessary benefits.

The current maximum amount for SSDI payments is $3,345 per month. For SSI payments, by contrast, the maximum monthly amount a disabled individual can receive in 2023 is $914 for an eligible individual, and $1371 for an eligible individual with an eligible spouse.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.