Loading

Get 10.pdf - This Is A Model Document For Use In Fannie Mae ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 10.pdf - THIS IS A MODEL DOCUMENT FOR USE IN FANNIE MAE ... online

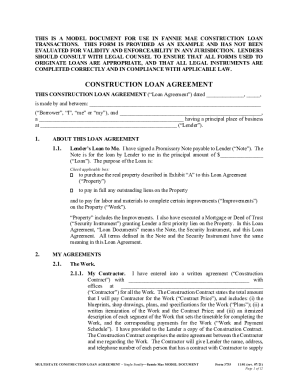

This guide provides a clear, step-by-step process for filling out the 10.pdf, a model document used in Fannie Mae construction loan transactions. Designed for users with varying levels of experience, this guide will help ensure that you complete the form accurately and efficiently online.

Follow the steps to successfully fill out the 10.pdf online.

- Press the ‘Get Form’ button to access the document and open it in the designated editor.

- Enter the date on which the construction loan agreement is being signed, in the format of month, day, and year.

- Provide the full name of the borrower in the designated field, ensuring to use the correct personal identification.

- Fill in the lender's name, ensuring to include any relevant designation or title associated with the lender.

- In section 1.1, note the principal amount of the loan in the designated field and check the appropriate box indicating the purpose of the loan, selecting either property purchase, lien payment, or improvement work.

- Enter the contractor's name and their business address in the subsequent sections, and ensure that all agreements related to the work, including plans and costs, are properly documented.

- Complete sections pertaining to permits and compliance with government regulations, ensuring all necessary documentation is attached as required.

- Review change order details, ensuring any modifications in agreement are properly documented and signed.

- Finally, ensure all signatures are affixed in the appropriate areas, and provide any additional required documentation, including exhibits. Double-check all entries for accuracy.

- Once completed, save your changes, download, print, or share the filled form as needed.

Complete your documents online with confidence and accuracy.

Master Form Deed of Trust means the Master Form Deed of Trust And Security Agreement, whether now or hereafter executed, duly executed by the Borrower for the benefit of the Lender securing the Indebtedness, each Master Form Deed of Trust to be recorded in each county in which an Eligible CMSA is located.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.