Loading

Get Employer/company: Please Retain A Copy Of This Document For Your Records

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Employer/Company: Please Retain A Copy Of This Document For Your Records online

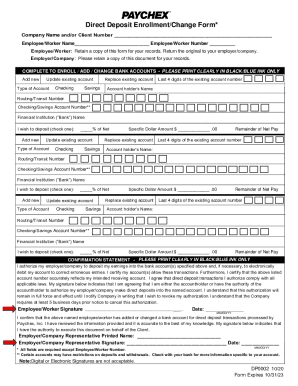

Filling out the Employer/Company: Please Retain A Copy Of This Document For Your Records form is an essential step for employees wishing to enroll, update, or change their direct deposit information. This guide will provide you with clear, step-by-step instructions to ensure the form is completed accurately and efficiently.

Follow the steps to accurately complete and submit your direct deposit form.

- Click the ‘Get Form’ button to obtain the form and access it online. This action will allow you to open the document in your browser.

- Begin filling in the company name and/or client number at the top of the document. Ensure that you enter this information clearly and accurately.

- In the next section, input your name as the employee or worker. Next, provide your employee or worker number in the designated space.

- Select whether you are adding a new bank account, updating an existing one, or replacing an existing account. Clearly mark your choice.

- Specify the type of account you are using by selecting either 'Checking' or 'Savings.' Be certain to check the box that corresponds with your choice.

- Provide the last four digits of your existing account number if applicable. This will help the employer identify any previous account information.

- Write down the account holder's name, the routing or transit number, and the checking/savings account number. Ensure that this information is accurate to avoid any deposit issues.

- Indicate how you would like your earnings to be deposited. You have options to add a new percentage of net pay, update existing account preferences, or specify a dollar amount. Clearly mark your choice.

- If using multiple accounts, repeat the steps to provide additional account information as needed. Be sure to fill out every required field.

- Review the confirmation statement and verify your understanding. By signing the form, you authorize your employer/company to deposit your earnings into the specified accounts.

- Date the form with the correct MM/DD/YY format. This is crucial for documentation and tracking your submission.

- Once all fields are completed, save your changes. You may also want to download, print, or share the form based on your documentation needs.

Complete your direct deposit enrollment or changes online today for a seamless payroll experience.

You must keep any data you collect on staff secure - lock paper records in filing cabinets or set passwords for computer records, for example. Only keep the information for as long as you have a clear business need for it, and dispose of it securely afterwards - by shredding, for example.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.