Loading

Get Or 735-9002 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OR 735-9002 online

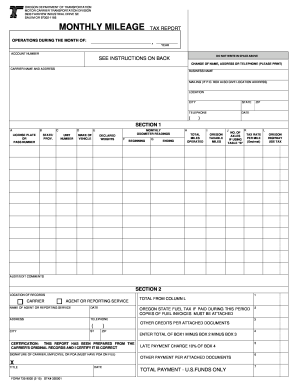

The OR 735-9002 form is essential for reporting monthly mileage and tax for motor carriers in Oregon. This guide will provide you with step-by-step instructions to complete this form efficiently online.

Follow the steps to accurately complete the OR 735-9002 form.

- Click the ‘Get Form’ button to access the OR 735-9002 online. This will allow you to obtain a copy of the form in a user-friendly editor.

- In the ‘Operations during the month of’ section, enter the month and year for which you are reporting. This information is critical for accurate tax assessments.

- Provide your account number in the designated field, ensuring this matches the information registered with the Motor Carrier Transportation Division.

- In the ‘Carrier name and address’ section, fill in your business name, physical address, and mailing information if applicable. Be sure to include your city, state, and ZIP code.

- For Section 1, enter the necessary details for each vehicle. This includes the license plate or pass number, state or province of issuance, unit number, make of vehicle, and declared weights.

- Record the beginning odometer reading for the reporting period. Make sure this matches the ending reading from the previous month.

- Enter the ending odometer reading, then calculate the total miles operated by subtracting the beginning odometer from the ending odometer.

- List the Oregon taxable miles, which are the miles driven on Oregon public roads during the reporting period.

- If applicable, input the number of axles and the corresponding tax rate per mile based on your vehicle's declared weight.

- Complete Section 2 by entering the location of your records, and provide contact information for your agent or reporting service, if applicable.

- After completing all sections, review your entries for accuracy, save any changes you have made to the form, and either download or print the document for your records.

- Finally, submit your completed form as per the instructions provided, ensuring it is sent before the due date to avoid late fees.

Begin filling out the OR 735-9002 online today to ensure timely reporting and compliance with Oregon tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can drive a car purchased from a private seller, but ensure you have the signed title and proof of sale on hand. Before hitting the road, make sure to register the vehicle and obtain insurance to comply with local laws. Also, check with your state’s requirements regarding temporary plates or permits. For comprehensive guidance, consider consulting OR 735-9002 or using US Legal Forms as a reliable resource.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.