Loading

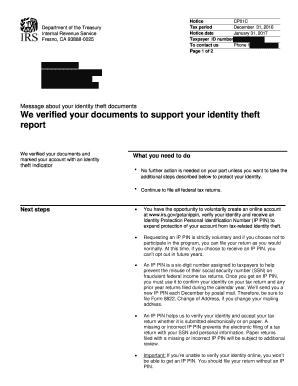

Get We Verified Your Documents To Support Your Identity Theft ... - Irs.gov

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the We Verified Your Documents To Support Your Identity Theft ... - IRS.gov online

This guide provides step-by-step instructions on how to fill out and file the We Verified Your Documents To Support Your Identity Theft ... form online. It is designed to assist users in navigating the process efficiently and effectively, ensuring that all necessary information is provided.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin filling out the relevant fields of the form. Ensure your taxpayer ID number is accurately entered as specified in the notice.

- If requested, consider whether to voluntarily create an online account to receive an Identity Protection Personal Identification Number (IP PIN). If proceeding, follow the prompts to verify your identity.

- Once all sections have been thoroughly completed and reviewed for accuracy, choose to save changes, download, print, or share the form as necessary.

Prepare and complete your documents online to safeguard your identity against potential theft.

What this letter is about. We received a federal income tax return, Form 1040-series, filed under your Social Security number (SSN) or individual tax identification number (ITIN). We need you to verify your identity and your tax return so we can continue processing it. If you didn't file a tax return, let us know.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.