Loading

Get Tips For Paediatricians Completing The Disability Tax Credit (dtc) Form ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tips For Paediatricians Completing The Disability Tax Credit (DTC) Form online

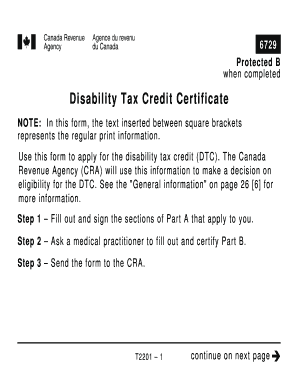

Completing the Disability Tax Credit (DTC) Form for children can be a crucial process for ensuring that individuals with disabilities receive the necessary support. This guide offers a clear, step-by-step approach to filling out the DTC Form online, making the experience smoother for paediatricians and caregivers alike.

Follow the steps to successfully complete the DTC Form.

- Press the ‘Get Form’ button to access the DTC Form and open it for editing.

- Begin with Part A, where you will fill out personal information regarding the person with the disability. This includes their first name, last name, social insurance number, and mailing address.

- Complete Section 2 if you are the person claiming the disability amount. If applicable, provide your name and relationship to the person with the disability. Answer questions about living arrangements and support provided.

- In Section 3, indicate whether you would like the CRA to adjust your income tax returns based on the approved eligibility for the DTC.

- Before proceeding to Part B, ensure you have a medical practitioner prepare and certify this section, highlighting the severity and duration of the individual's impairment.

- Fill out relevant sections on Pages 9 to 25, where the medical practitioner details the effects of the impairment and certifies the necessary information.

- Complete the certification portion, confirming the accuracy of the information submitted, and have the medical practitioner sign and date the form.

- Once all sections are completed and verified, save your changes, download the completed form, and consider printing or sharing it with relevant parties as necessary.

Complete and submit the DTC Form online to help support individuals with disabilities.

The Child Tax Credit is a tax benefit granted to American taxpayers with children under the age of 17 as of the end of the year. For the 2022 tax year, the credit is $2,000 for each qualifying child. The credit also is no longer refundable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.