Loading

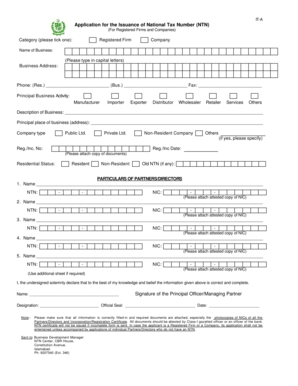

Get Bapplicationb For The Issuance Of National Tax Number Ntn Bb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the application for the issuance of national tax number NTN online

This guide provides users with clear and comprehensive instructions on how to accurately complete the application for the issuance of a national tax number (NTN) online. Whether you are a registered firm or a company, following these steps will help ensure your application is submitted correctly.

Follow the steps to successfully complete your application

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the appropriate category by ticking one of the options: Registered Firm or Company.

- Enter the name of your business using capital letters as specified.

- Provide the business address, including the phone numbers for both residential and business contacts, as well as the fax number.

- Choose the principal business activity from the provided options, such as Manufacturer, Importer, or Services. You may select 'Others' if your activity is not listed.

- Describe your business in detail in the description section.

- Specify the principal place of business by providing the address.

- Indicate the company type by selecting one of the options: Public Ltd., Private Ltd., Non-Resident Company, or Others. If selecting 'Others,' please specify.

- Provide the registration or incorporation number and the date, ensuring all relevant documents are attached.

- Select your residential status, indicating whether you are a Resident or Non-Resident.

- If applicable, enter any old NTN that you may have.

- Fill in the particulars of all partners or directors, including their names, NTN, and NIC numbers. Remember to attach an attested copy of the NIC for each individual.

- If needed, use additional sheets to provide details for more partners or directors.

- Complete the declaration section by providing your name, signing the document, indicating your designation, and adding the official seal along with the date.

- Before submitting, verify that all fields are correctly filled out and the required documents are attached. Incomplete applications will not be entertained.

- Once everything is in order, save your changes, download the form, print it if necessary, or share it as required.

Complete your application for the national tax number online today!

performing following steps: Visit the FBR Portal at https://e.fbr.gov.pk. Select the taxpayer type (Individual, AOP, or Company) Enter the CNIC/NTN/Reg.Inc, ing to the selected taxpayer type. Enter Name of taxpayer. Enter "Image character" Click "Ok"

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.