Loading

Get Application For Loan Against Deposit Receipt - Stfc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Loan Against Deposit Receipt - STFC online

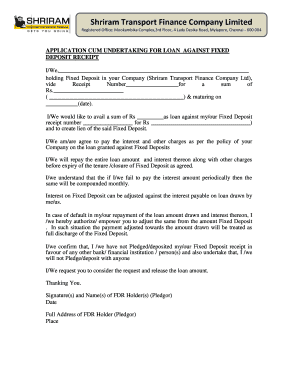

This guide aims to assist users in completing the Application For Loan Against Deposit Receipt from Shriram Transport Finance Company Limited online. It provides step-by-step instructions tailored for users of all experience levels, ensuring a smooth application process.

Follow the steps to fill out your application easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the holder's name in the designated field. Ensure you enter the full legal name as it appears on the Fixed Deposit Receipt.

- Input the receipt number associated with your Fixed Deposit. This number is crucial for your application, as it links your loan request to the correct deposit.

- State the amount for which you are applying as a loan against your Fixed Deposit. Be clear and precise to avoid any discrepancies.

- Enter the maturity date of your Fixed Deposit. This date indicates when the deposit will reach its full term.

- Agree to the terms outlined in the application regarding interest payments and other charges by checking the corresponding agreement box, confirming your understanding of the conditions.

- Review the section that discusses repayment. Confirm your commitment to repay the loan before the maturity of the Fixed Deposit.

- If applicable, provide details regarding any prior pledges of your Fixed Deposit to ensure compliance with the institution’s policies.

- Sign and date the form, ensuring that your signature matches the name provided at the beginning. Include your full address in the designated section.

- Review all the information filled out in the form for accuracy before saving your changes.

- Once completed, download, print, or share the filled-out form as necessary, ensuring you keep a copy for your records.

Start your loan application process online now!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Loans are typically better suited for the long term. The repayment tenure can range from 5 years to 20 years or more. On the other hand, the overdraft option is a short-term credit facility, and is ideal if you have short-term fund requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.