Loading

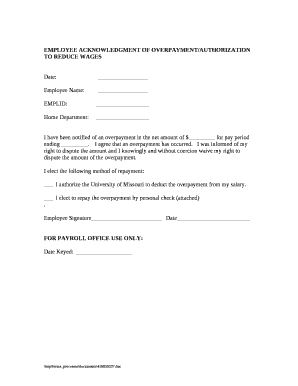

Get Employee Acknowledgment Of Overpayment Authorization To Reduce Wages

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Acknowledgment Of Overpayment Authorization To Reduce Wages online

Filling out the Employee Acknowledgment Of Overpayment Authorization To Reduce Wages form online is an important step in acknowledging any overpayment received. This guide provides a clear, step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date at the top of the form in the designated space. This should be the date you are completing the form.

- Fill in your full name in the 'Employee Name' field. Ensure that you use your name as it appears in official documents.

- Provide your EMPLID in the specified field. This unique identifier is crucial for payroll records.

- Indicate your home department in the section provided. This helps in identifying your department within the organization.

- In the section regarding overpayment, enter the net amount of overpayment you have been notified of and the pay period in which it occurred.

- Acknowledge the statement regarding your awareness of the overpayment by initialing or signing where specified.

- Choose your preferred method of repayment by marking the relevant checkbox — either by salary deduction or personal check. If you opt for a personal check, ensure it is attached.

- Sign the form where indicated, and enter the date of your signature, confirming your agreement to the terms outlined.

- Once everything is completed, save your changes, download, print, or share the form as required.

Complete your forms online efficiently by following these steps.

Under the Federal Labor Standards Act (FLSA) - the federal law governing wage and hour issues - employers can deduct the full amount of overpayments to employees, even if doing so would bring the employee's wages below minimum wage for the pay period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.