Loading

Get Depreciation Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Depreciation Worksheet online

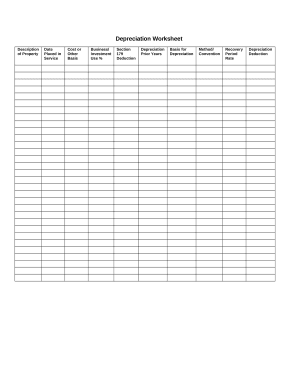

The Depreciation Worksheet is a vital tool for users to calculate the depreciation of their assets effectively. This guide provides clear, step-by-step instructions to help you fill out the worksheet online, ensuring accurate reporting of your property’s depreciation.

Follow the steps to complete your Depreciation Worksheet online.

- Click the ‘Get Form’ button to obtain the worksheet and open it in your online editing tool.

- Begin by filling out the 'Description of Property' field. Enter a clear and concise description of the asset you are reporting. This helps in identifying the property during assessments.

- In the 'Date Placed in Service' section, input the date you started using the asset for business or investment purposes. This date is critical for determining the start of the depreciation period.

- Next, provide the 'Cost or Other Basis' of the property. This should include the purchase price and any additional costs necessary to make the asset usable.

- Enter the 'Business/Investment Use %'. Specify the percentage of time the asset will be used for business or investment activities. This figure impacts the allowable depreciation deduction.

- If applicable, include the 'Section 179 Deduction' amount. This deduction allows users to deduct the full cost of the asset in the year it is placed in service, subject to certain limits.

- In the 'Depreciation Prior Years' section, provide any depreciation amounts that have been recorded in previous years. This ensures that calculations are based on the correct adjusted basis.

- Fill out the 'Basis for Depreciation', which is the remaining value of the asset after accounting for prior depreciation and Section 179 deductions.

- Select the 'Method/Convention' for recording depreciation. Common methods include straight-line and declining balance, which determine how depreciation is calculated over time.

- Complete the 'Recovery Period Rate'. This is the timeframe over which the asset will be depreciated, according to tax law guidelines.

- Finally, calculate and enter the 'Depreciation Deduction' amount for the current year. Ensure all necessary fields are reviewed before finalizing.

Once completed, be sure to save, download, print, or share your Depreciation Worksheet online.

IRS Form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Assets such as buildings, machinery, equipment (tangible), or patents (intangible) qualify. Land cannot depreciate, and so it can not be reported on the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.