Loading

Get Sch F.pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sch F.pdf online

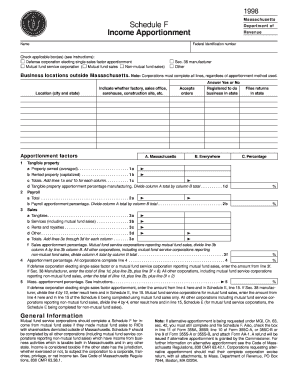

The Sch F.pdf form is essential for reporting income apportionment in Massachusetts. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to effectively complete the Sch F form.

- Click the 'Get Form' button to access the Sch F.pdf document and open it in your preferred online editor.

- Begin by entering your name and federal identification number at the top of the form. Ensure these details are correct as they will be used for identification purposes.

- Check the applicable box(es) to indicate your specific business type, such as defense corporation, mutual fund service corporation, or other as needed.

- Provide information about business locations outside Massachusetts. Clearly indicate the city and state, and specify the type of location (e.g., factory, sales office).

- Fill out the apportionment factors. For each apportionment category (tangible property, payroll, sales), complete all lines and calculate the percentages as instructed.

- For the property factor, differentiate between owned and rented properties. Ensure you average the values as required.

- For payroll, enter total compensation paid to employees. Ensure compliance with the guidelines regarding the allocation of payroll to Massachusetts.

- For sales, report all applicable sales figures. Make sure to understand how to assign sales to Massachusetts or other states based on specific criteria.

- Carefully check your entries for accuracy. When complete, you can save your changes, download, print, or share the Sch F.pdf form as necessary.

Start filling out your Sch F.pdf form online today to ensure a smooth filing process.

The IRS defines deductible expenses as “ordinary and necessary costs of operating a farm for profit.” These expenses include insurance, labor hired, repairs & maintenance, interest, travel expense, feed, fertilizer, seed, advertising, marketing fees, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.