Loading

Get Qsf Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the QSF Distribution Form online

Filling out the QSF Distribution Form online may seem daunting, but this guide simplifies the process. Follow these steps to ensure accurate and efficient completion of the form.

Follow the steps to successfully complete the QSF Distribution Form online.

- Click the ‘Get Form’ button to access and open the QSF Distribution Form in your preferred online editor.

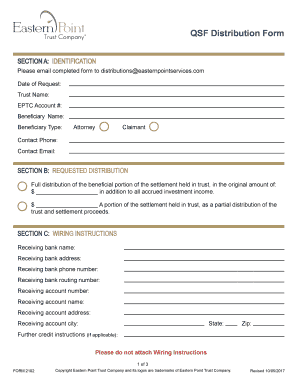

- In Section A, enter your identification details, including the date of request, trust name, EPTC account number, beneficiary name, beneficiary type (Attorney or Claimant), contact phone, and contact email. Ensure all fields are filled out accurately.

- Proceed to Section B, where you will specify the distribution requested. Choose either a full distribution of the beneficial portion and input the total amount, or select the option for a partial distribution and indicate the desired amount.

- Navigate to Section C to provide wiring instructions. Include the receiving bank name, address, phone number, routing number, account number, account name, and mailing address, as well as any further credit instructions if applicable.

- In Section D, carefully read and acknowledge the authorization statements. As the signer, attest to your authority and responsibility, and provide your printed name, signature, and the date.

- Attach any necessary documents, such as the resolution of authorized officers/partners or a W-9 for the beneficiary payee, if applicable. Check the corresponding boxes to indicate attachments.

- Once all sections are completed, save your changes. You may then download, print, or share the completed form with the designated email address: distributions@easternpointservices.com.

Start filling out your QSF Distribution Form online today for a seamless submission process.

Taxation of Qualified Settlement Funds. Income earned by the QSF is taxed at a rate equal to the maximum rate in effect for such taxable year for trusts. [16] For 2020, the QSF rate is 39.6%. [17] All income is taxed at the same rate, there are no lower brackets.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.