Loading

Get Irs Publication 786

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

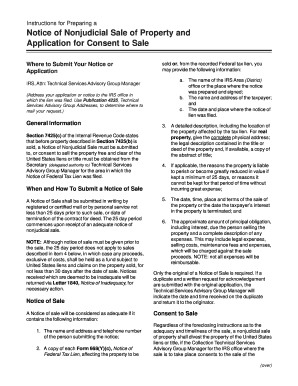

How to fill out the IRS Publication 786 online

Filling out the IRS Publication 786 online can be a straightforward process if you understand each component and section of the form. This guide provides clear, step-by-step instructions to help you navigate and complete the form effectively.

Follow the steps to fill out the IRS Publication 786 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the general information section to understand the requirements for submitting the Notice of Nonjudicial Sale and the Application for Consent to Sale.

- Fill in your name, address, and telephone number in the designated fields to provide your contact information.

- Attach copies of each Form 668(Y)(c), Notice of Federal Tax Lien. Ensure you include the name of the IRS Area office, taxpayer's information, and the date and location where the lien was filed.

- Provide a detailed description of the property affected by the tax lien, including its physical address and legal description.

- If applicable, include reasons why the property cannot be held for 25 days, or its condition if kept that period will cause it to perish or lose value.

- Specify the date, time, place, and terms of the sale of the property.

- List the approximate amount of principal obligation due, including any related expenses.

- Sign and date the application, including the declaration over your signature stating the truthfulness of the information provided.

- Finalize your submission by saving changes and downloading, printing, or sharing the form as needed.

Begin completing the IRS Publication 786 online today to ensure your submission is accurate and timely.

If the taxpayer makes no payment within ten days of the demand, the IRS can send out a notice of federal tax lien. The IRS will then send you in the mail a Notice of Federal Tax Lien after the tax lien has been filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.