Loading

Get Hrp Qualifying Years

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hrp Qualifying Years online

This guide provides clear and supportive instructions on completing the Hrp Qualifying Years form online. By following these steps, you can ensure that you accurately fill out the necessary information to apply for Home Responsibilities Protection.

Follow the steps to successfully complete the Hrp Qualifying Years form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

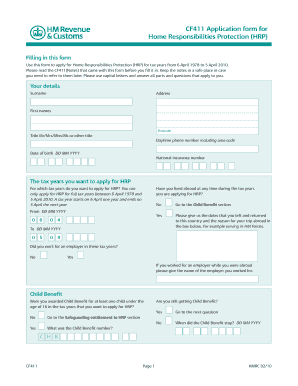

- Begin by entering your personal information in the 'Your details' section. This includes your surname, first names, address, postcode, title, daytime phone number with area code, date of birth, and National Insurance number.

- In the section titled 'The tax years you want to apply for HRP', indicate if you have lived abroad during the tax years you are applying for HRP. If you have lived abroad, provide the dates of departure and return, along with the reason for your trip.

- Next, answer whether you worked for an employer during these tax years. If yes, provide the name of the employer.

- Proceed to the 'Child Benefit' section. Indicate if you were awarded Child Benefit for any child under the age of 16 during the relevant tax years. If applicable, provide the Child Benefit number and details of the children, including their full names and dates of birth.

- In the 'Safeguarding entitlement to HRP' section, indicate if you wish to transfer HRP from the Child Benefit claimant’s National Insurance account to your own. Provide the necessary details if applicable.

- Answer the questions related to the individuals you looked after. Indicate if you looked after a sick or disabled person for at least 35 hours per week and provide their details if needed.

- Complete the 'Foster caring' section by answering whether you were an approved foster carer and providing necessary confirmation if applicable.

- Finally, review all sections of the form to ensure accuracy. When you have completed the form, save your changes and ensure you have any necessary documentation ready for submission.

- Once everything is finalized, download, print, and send your completed form along with required documents to HM Revenue & Customs at the designated address.

Take the next step and complete your Hrp Qualifying Years form online today.

To claim HRP , fill in form CF411. You can fill in this form to transfer HRP from someone else. You can also contact the HMRC National Insurance helpline for an application form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.