Loading

Get Initial Escrow Account Disclosure Statement - Files Consumerfinance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INITIAL ESCROW ACCOUNT DISCLOSURE STATEMENT - Files Consumerfinance online

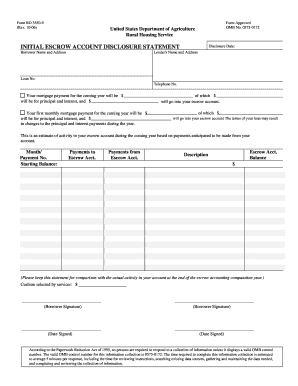

This guide provides straightforward instructions for filling out the Initial Escrow Account Disclosure Statement. Designed to assist borrowers, this document outlines essential information related to escrow accounts in a user-friendly manner.

Follow the steps to fill out the initial escrow account disclosure statement accurately.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your name and address in the 'Borrower Name and Address' section. Ensure accuracy to avoid issues later.

- Fill in the 'Disclosure Date' to indicate when you are completing this statement.

- Provide your lender's name and address in the designated fields. This helps to identify the financial institution associated with your loan.

- Enter your loan number in the appropriate field. This is usually found on your loan documents.

- Include a telephone number where you can be reached, ensuring that your lender can contact you if necessary.

- In the section that details your mortgage payment for the coming year, input the amounts for principal and interest, as well as anticipated changes.

- Specify the amount that will go into your escrow account from your monthly mortgage payments.

- Estimate the activities in your escrow account for the coming year, including both payments to and from the account.

- Record the starting balance of the escrow account at the top of the monthly breakdown section.

- For each month listed, document the payments going into and coming out of your escrow account, as well as the balance for each month.

- Review the cushion selected by your servicer and input it in the designated field.

- Sign and date the form where indicated to verify that the information provided is accurate.

- Once completed, ensure all information is correct and then save any changes, download a copy, or print the document for your records.

Complete your documents online today for a smoother transaction!

Some accountants choose to account for the net total of escrow accounts by including the amount in the escrow account as a debit and the cash dispersed from the escrow account as a credit. The debit minus the credit will show $0, helping to account for the funds without the appearance of having more cash available.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.