Loading

Get Crdb Bank Loan Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crdb Bank Loan Application Form online

Filling out the Crdb Bank Loan Application Form online is a straightforward process that requires careful attention to detail. This guide will take you through each section of the form, ensuring you provide the necessary information accurately.

Follow the steps to complete the application form effectively.

- Click ‘Get Form’ button to retrieve the application form and open it for editing.

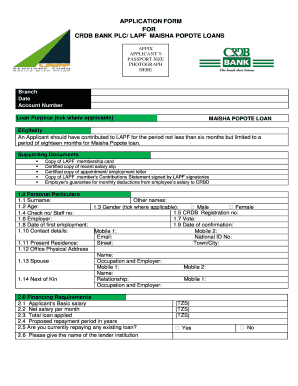

- Begin by affixing your passport-sized photograph in the designated area. Ensure it is recent and clearly visible.

- Complete the Eligibility section by confirming that you have contributed to LAPF for a minimum of six months, but not exceeding eighteen months for this loan.

- Proceed to the Personal Particulars section. Provide your surname, other names, age, and gender by ticking the appropriate box.

- In the Present Residence section, provide your street address, town, or city.

- Fill in your spouse's occupation, their employer, and contact details in the relevant sections.

- Transition to Financing Requirements. Input your basic salary, net salary, total loan amount applied for, and the desired repayment period in years.

- In the Applicant’s Declaration section, affirm that all details are accurate and complete. Sign and date the form accordingly.

- The LAPF officials will review your application in the designated section. Details such as contributions and officer opinions should be filled by them.

- Review the entire application for accuracy, save any changes, and download the completed form for your records. You may also choose to print or share the form as required.

Take the first step towards securing your loan by completing your application form online today!

Personal loan documents your lender may require Loan application. Each lender will have an application to initiate the loan process, and this application can look different from lender to lender. ... Proof of identity. ... Employer and income verification. ... Proof of address. ... Credit score. ... Loan purpose. ... Monthly expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.