Get Ga T-140 Schedule C 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA T-140 Schedule C online

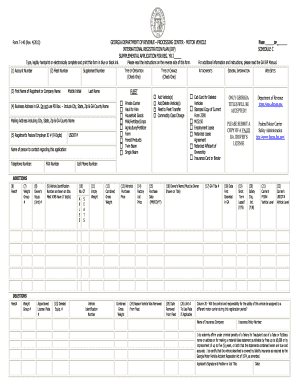

Filling out the GA T-140 Schedule C online is a crucial step for users looking to manage their fleet registration effectively. This guide provides clear, step-by-step instructions on how to complete the form accurately and efficiently.

Follow the steps to complete the GA T-140 Schedule C.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account number in the designated field. This is the number assigned to you during your initial application.

- Fill in the fleet number. A fleet consists of one or more vehicles that travel the same states.

- Input the registrant's name, which can be an individual, business, or corporation, as shown on your original application.

- Provide the business address in Georgia, ensuring you do not use a P.O. Box. Include the city, state, zip code, and county name.

- If applicable, type in the registrant’s Federal Employer ID number (nine digits).

- Complete the vehicle details including owner’s equipment number, vehicle identification number (VIN), number of axles, empty weight, and combined gross weight.

- Specify the vehicle purchase price and the factory list price, ensuring there are no cents noted.

- Indicate the date of purchase using the MM/DD/YY format and provide the owner's name as shown on the vehicle title.

- Fill out the date the vehicle first operated in Georgia and indicate whether it is under a short-term lease.

- If relevant, answer whether the safety control will be assigned to a different carrier during this registration period.

- Complete the section for deletions if any vehicles are being removed, stating the reason for removal and the date.

- Review all entries for accuracy and completeness.

- Once finished, save your changes, download, print, or share the form as needed.

Begin filing the GA T-140 Schedule C online today to manage your fleet registration efficiently.

Get form

The Schedule C on the 1040 form details the profit or loss from a business operated as a sole proprietorship. It allows you to report your revenue and expenses, paving the way for an accurate net income figure on your tax return. The GA T-140 Schedule C is instrumental in ensuring you capture all eligible deductions and maintain compliance with tax laws. Utilizing this form effectively can help optimize your tax outcomes.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.