Loading

Get Ga T-140 Schedule C 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA T-140 Schedule C online

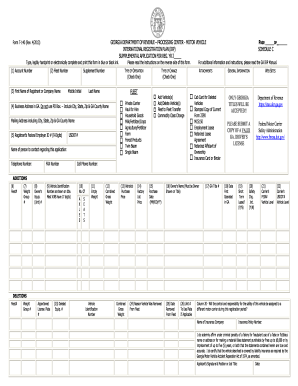

The GA T-140 Schedule C is a supplemental application form used to add or delete vehicles from a fleet under the International Registration Plan (IRP) in Georgia. This guide provides a step-by-step approach to help users complete the form online accurately and efficiently.

Follow the steps to complete the GA T-140 Schedule C online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account number, which was assigned on your initial IRP application, in the designated field.

- Fill in the fleet number, which is a three-digit code assigned to your fleet during the initial application or renewal process.

- Provide the registrant's name, which should match the person, firm, or corporation registered on your original application.

- Insert your business location in Georgia. Please avoid using a P.O. Box and include the city, state, zip, and county name.

- Enter your federal employer identification number, which is required if you operate at a gross combined weight of 55,000 pounds or more.

- Indicate the type of operation by checking the appropriate box, such as Private Carrier or Haul for Hire.

- List the type of change you are making by selecting the relevant check box for adding or deleting vehicles.

- For additions, fill in the details for each vehicle including the owner's equipment number and vehicle identification number (VIN). Make sure to provide the correct number of axles and weight information.

- If you are deleting vehicles, indicate the deleted equipment number and provide the reason for removal, along with the date removed.

- Complete any additional information required, such as the owner's name, insurance details, and any attachments specified.

- Once you have filled out all necessary sections, review your entries for accuracy, and then save the changes, download, print, or share the completed form as needed.

Complete your GA T-140 Schedule C online today for a smooth registration process.

To calculate income on Schedule C, total all business revenues and deduct any and all business expenses. It’s imperative to ensure that all potential deductions receive proper consideration for an accurate representation of income. By following these steps, you can confidently complete your GA T-140 Schedule C with the right figures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.