Loading

Get Ct Cla-12 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CLA-12 online

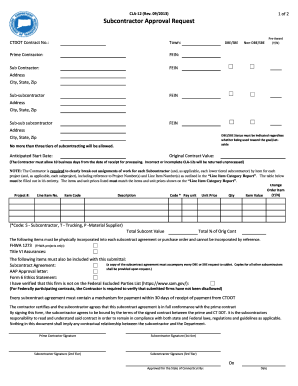

The CT CLA-12 form, known as the Subcontractor Approval Request, is essential for contractors looking to approve subcontractors before a project's award. This guide provides clear, step-by-step instructions for completing the CT CLA-12 online to ensure compliance and streamline the approval process.

Follow the steps to effectively complete the CT CLA-12 form online.

- Click ‘Get Form’ button to access the CT CLA-12 document and open it in the editor.

- Begin filling out the basic information section, including fields for CTDOT Contract Number, Town, Prime Contractor details, and the Federal Employer Identification Numbers (FEIN) for both the Prime Contractor and the Subcontractor.

- Indicate whether the Subcontractor is a Disadvantaged Business Enterprise (DBE) or Small Business Enterprise (SBE) or non-DBE/SBE by checking the appropriate box.

- Provide the complete address for the Subcontractor, including the City, State, and Zip Code.

- If applicable, you may include information for Sub-subcontractors by adding their details in the designated sections, ensuring to specify the DBE/SBE status.

- Enter the anticipated start date for the subcontract work, as well as the original contract value.

- Fill in the table provided for detailing assignments of work for each subcontractor. Ensure that items and unit prices match those outlined in the Line Item Category Report.

- Indicate whether there are any change orders related to the items listed and complete the corresponding fields.

- Ensure that all items required to be included in the subcontract agreement are listed, including FHWA 1273 and Title VI Assurances.

- Verify that a copy of the subcontract agreement accompanies any DBE or SBE requests.

- Finally, review all entries for accuracy, then save changes. You can download, print, or share the form as needed.

Start completing your CT CLA-12 form online today!

To file workers comp in CT, you must submit the appropriate forms to the Connecticut Workers' Compensation Commission. It is essential to complete your filing accurately to avoid penalties. CT CLA-12 provides insights and guidance on the necessary steps to ensure compliance and proper documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.