Loading

Get H-4. Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the H-4. Model Form For Credit Score Disclosure Exception For Loans Not Secured By Residential Real online

This guide provides clear and supportive instructions on how to accurately fill out the H-4. Model Form for credit score disclosure exceptions. Understanding each section of the form will help you complete it efficiently and correctly.

Follow the steps to complete the H-4 form online effectively.

- Click ‘Get Form’ button to obtain the form and access it for completion.

- Input the name of the entity providing the notice in the designated field at the top of the form.

- Enter the credit score in the specified section, ensuring accuracy.

- Provide the source of the credit score in the related field.

- Insert the date when the credit score was created in the appropriate area.

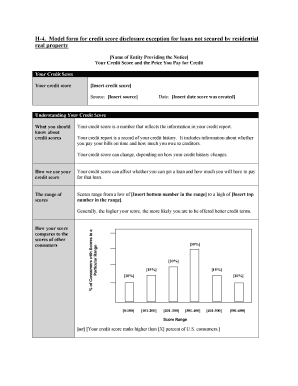

- Read the section titled 'Understanding Your Credit Score' to ensure you comprehend how credit scores are assessed.

- Fill out the range of scores by entering the minimum and maximum values in the designated blanks.

- Include the comparative information about the credit score compared to other consumers based on the provided chart.

- If applicable, describe any disputes regarding inaccurate information in your credit report.

- Finalize the document by reviewing all entered information for errors and ensuring clarity.

- Once satisfied, you can save changes, download, print, or share the completed form as needed.

Complete your documents online today to ensure timely processing.

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.