Get Annexure -1 Letter Depositing Fixed Short Deposit Not To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

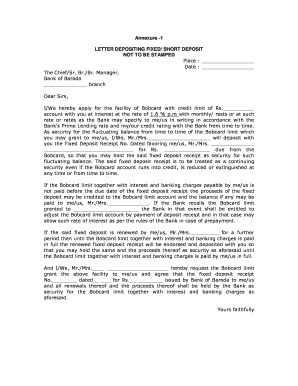

How to fill out the Annexure -1 LETTER DEPOSITING FIXED SHORT DEPOSIT NOT TO online

This guide provides a detailed walkthrough for filling out the Annexure -1 LETTER DEPOSITING FIXED SHORT DEPOSIT NOT TO form online. Users will find clear instructions regarding each section of the form, tailored to ensure a smooth and efficient experience.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Annexure -1 LETTER DEPOSITING FIXED SHORT DEPOSIT NOT TO form and open it in the editor.

- In the 'Place' field, insert the location where you are completing this form.

- In the 'Date' field, write the current date on which you are filling out the form.

- Address your application to the Chief/Sr. Branch/Branch Manager at your designated Bank of Baroda branch, writing the branch name in the provided space.

- In the opening statement, specify whether the applicant is an individual or a group using 'I' for singular or 'We' for plural.

- Fill in the requested credit limit amount in the designated space to indicate the desired amount to be applied for.

- Indicate the applicable interest rate, which is 1.6% per month, or specify any other rate mentioned by the bank.

- Provide the security information by entering the Fixed Deposit Receipt number and date in the appropriate fields.

- Name the individual(s) to whom the fixed deposit receipt is favoring in the provided area.

- Detail the amount of the fixed deposit in the specified field.

- At the bottom of the form, provide your name or the names of the individuals applying for the Bobcard limit in the 'Yours faithfully' section.

- Finally, review the information entered for accuracy and completeness before saving your changes or downloading the form.

Complete your document online today for a seamless experience.

Outward clearing is a process taking place at the bank branch level. This is where deposited cheques are electronically scanned and verified before sent on to the service branch. Inward clearing is the process taking place at the service branch, where the received cheques are verified and balanced. What Is the CTS Clearing Process? - GoCardless gocardless.com https://gocardless.com › en-au › guides › posts › what-is-... gocardless.com https://gocardless.com › en-au › guides › posts › what-is-...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.