Loading

Get Rajtax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rajtax online

Filling out the Rajtax form accurately is essential for proper tax compliance. This guide provides clear, step-by-step instructions tailored for all users, including those with limited experience in legal documentation.

Follow the steps to complete the Rajtax form efficiently.

- Press the ‘Get Form’ button to access the Rajtax form and open it in the editor.

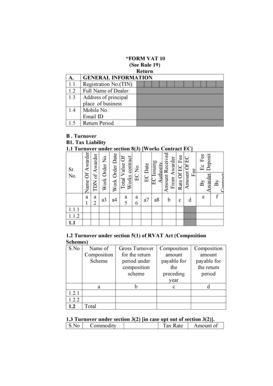

- Begin by filling in the general information section. Enter your registration number (TIN), your full name, and the address of your principal place of business. Additionally, provide your mobile number, email ID, and the return period.

- In the forms related to the awarder, enter details such as the name of the awarder, TDN of the awarder, and specifics about the contract, including the contract amount and the EC details.

- Move to the turnover section. Specify your taxable turnover under various sections of the RVAT Act. For each category, make sure to include the turnover amounts, applicable tax rates, and calculate the total tax amount owed.

- Provide details for sales tax, including sales returns of taxable goods, and ensure to mention any output tax due as calculated from your turnover.

- Continue to the purchase tax section, detailing the commodities purchased, the turnover, and the amounts of tax applicable. This includes both input tax and details of capital goods purchases.

- Complete the CST details by entering the tax liability under CST and specifying any turnover not liable for tax. Carefully detail each entry and ensure accuracy in the amounts listed.

- In the final sections, summarize the overall tax payable, including any reverse tax and total amounts due. Review your entries thoroughly.

- Upon completion of the form, save your changes. You may also choose to download and print the form for your records or share it as needed.

Complete your Rajtax filing online today for accurate and efficient tax management.

Launching the protest at their head office, Rajasthan Commercial Taxes Service Association (RCTSA) also demanded that all positions from assistant commercial taxes officers (ACTO) to additional commissioners in the VAT regime be designated as assistant commissioner to special commissioners in the GST regime in ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.