Loading

Get Gift Deed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gift Deed online

Filling out a gift deed online can streamline the process of transferring property rights. This guide provides step-by-step instructions to help users accurately complete the gift deed form, ensuring all necessary information is included.

Follow the steps to fill out the Gift Deed form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

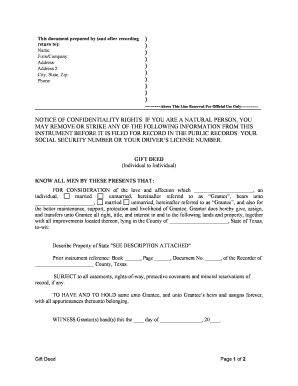

- In the first section, enter the name of the prepared by party, including their firm or company if applicable. Provide a complete address, including street address, city, state, and zip code, along with a contact phone number.

- Proceed to the 'Grantor' section. Write the name of the person giving the gift. Specify whether they are married or unmarried, and ensure that this information accurately reflects their current status.

- In the 'Grantee' section, enter the name of the person receiving the gift, along with their marital status. This section is critical as it indicates who will hold the property rights.

- Provide a detailed description of the property being transferred. You can reference an attached description if necessary, ensuring clarity and accuracy in the details.

- Fill out the prior instrument reference, including book, page, and document number related to the property's previous registration, if applicable.

- Ensure to include any easements, rights-of-way, or mineral reservations associated with the property in the relevant section.

- The grantor must sign on the designated line, along with the printed name. Follow this with the witness section, where two witnesses must sign and print their names.

- Complete the notary section by including the appropriate state and county. The notary public must acknowledge the signatures on the specified date.

- Finally, confirm that the tax statements are directed to the grantee by completing the last section with their name, address, and phone number.

- Once you have filled out all the required fields thoroughly, review the information for accuracy. You can then save your changes, download the document, print it, or share it as necessary.

Start completing your gift deed online today for a smooth property transfer process.

In California, you can use either a grant deed or a quitclaim deed to gift property into someone else's name. You can simply say on the deed that there's no consideration or that you're transferring title out of affection.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.