Loading

Get Tx Ef49-11523 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX EF49-11523 online

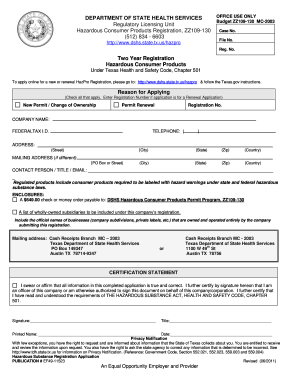

This guide will assist you in completing the TX EF49-11523 form for hazardous consumer products registration online. It outlines each section of the form and provides clear instructions to help you navigate the process with ease.

Follow the steps to successfully fill out the TX EF49-11523 form online.

- Press the ‘Get Form’ button to acquire the form and access it in the online editor.

- Specify the reason for applying by checking all applicable boxes—whether for a new permit, change of ownership, or permit renewal. If you are renewing, enter your registration number.

- Enter your company name and federal tax identification number precisely as they appear in your official documents.

- Provide a contact telephone number, ensuring that the area code is included.

- Complete your primary address, including city, street, state, zip code, and country, making sure every detail is accurate.

- If your mailing address differs from your primary address, fill in the respective fields according to your mailing details.

- List the contact person’s name, title, and email to facilitate communication regarding the application.

- Prepare and attach the necessary documents, including a payment of $649.00 and the list of wholly-owned subsidiaries.

- Review all information carefully to ensure accuracy. After verification, save your changes, download the form, or share it as needed.

Complete your TX EF49-11523 application online today for a smooth registration process.

The penalty for a tax delay can vary, but typically it involves a percentage of the owed amount for each month your taxes remain unpaid. This can add up quickly, making timely filing essential. Familiarity with the regulations of TX EF49-11523 can help you avoid delayed penalties and ensure a smoother filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.