Loading

Get Form A 114

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form A 114 online

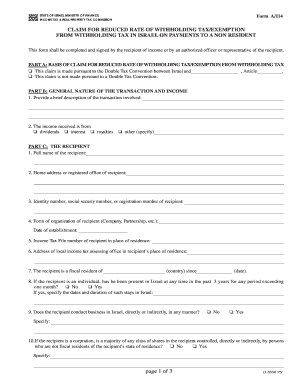

Filling out Form A 114 correctly is crucial for any non-resident seeking a reduced rate of withholding tax or exemption in Israel. This guide provides you with clear, step-by-step instructions to navigate the form effectively, ensuring you understand each section and field.

Follow the steps to complete Form A 114 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- In Part A, select whether the claim is made pursuant to a Double Tax Convention or not by checking the appropriate box.

- In Part B, provide a brief description of the transaction involved and select the type of income received by checking the relevant box.

- In Part C, fill out the full name, home address, identity number or registration number, form of organization, date of establishment, income tax file number, and address of local income tax assessing office for the recipient.

- Indicate the country of fiscal residence and the date, as well as answer questions about the recipient's presence in Israel and their business operations, providing details where required.

- In Part D, include the full name, home address, income tax file number of the payer, and state if any special relationship exists between the payer and the recipient.

- In Part E, document the details of the income received including the date and place of receipt, amount, description, method of calculation, and specify if similar items of income have been previously claimed.

- Attach all relevant documents in Part F, listing them clearly.

- In Part G, provide the recipient's declarations, including their signature and the date, along with the name, capacity, and address of any authorized officer or representative.

- In Part H, after the form has been completed, ensure certification from the foreign income tax authority is included, with the official's signature, position, address, and date of signature.

- Finally, save your changes, and proceed to download, print, or share the form as needed.

Complete your Form A 114 online today to ensure you maximize your tax benefits efficiently.

You report the accounts by filing a Report of Foreign Bank and Financial Accounts (FBAR) on Financial Crimes Enforcement Network (FinCEN) Form 114.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.