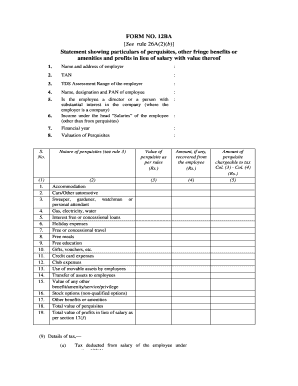

Get 12ba See Rule 26a(2)(b) Statement Showing Particulars Of Perquisites, Other Fringe Benefits Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 12BA See Rule 26A(2)(b) Statement showing particulars of perquisites online

This guide provides a clear and supportive framework for completing the 12BA See Rule 26A(2)(b) Statement showing particulars of perquisites, other fringe benefits or amenities, and profits in lieu of salary online. Whether you are familiar with tax documents or encountering this form for the first time, the following steps will help ensure accurate and complete submissions.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to access the form and open it in your browser or editor.

- Begin by entering the name and address of the employer in the first section of the form.

- Input the Tax Deduction and Account Number (TAN) in the designated box.

- Specify the TDS assessment range of the employer as required.

- Provide the name, designation, and Permanent Account Number (PAN) of the employee in the next section.

- Indicate whether the employee is a director or a person with substantial interest in the company, particularly if the employer is a corporation.

- State the income under the head 'Salaries' for the employee, excluding perquisites.

- Identify the financial year for which the statement is being prepared.

- Detail the valuation of perquisites in accordance with established rules.

- In the table provided, list each nature of perquisite along with its value, specifying any amounts recovered from the employee.

- Continue entering data for all relevant perquisite types, ensuring each is documented with its accurate value and any recovered amounts.

- Calculate total values for both perquisites and profits in lieu of salary, based on the sums provided in previous fields.

- Complete the section regarding tax details, including tax deducted from the employee's salary and any taxes paid by the employer on their behalf.

- Enter the date of payment into the Government treasury for the taxes accounted for.

- Finally, the employer must complete the declaration by providing their name, designation, and signing to verify the information is true and correct. Ensure all required fields are filled out before proceeding.

- Once all sections of the form are completed, review the information for accuracy. Save changes, download, print, or share the form as needed.

Complete your 12BA form online today to ensure accurate and timely submissions.

Related links form

A fringe benefit is a form of pay for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work. Performance of services. A person who performs services for you doesn't have to be your employee.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.