Loading

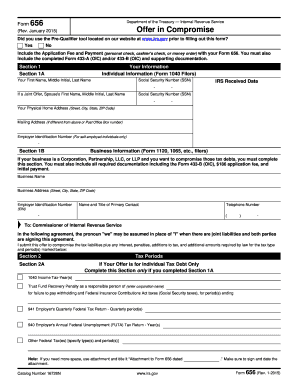

Get Form 656, Offer In Compromise - Irs.gov - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 656, Offer In Compromise - IRS.gov - Irs online

Filling out the Form 656, Offer In Compromise, is an essential step for those seeking to settle their tax liabilities with the IRS. This guide provides a clear, step-by-step breakdown of the form to help users accurately complete it online.

Follow the steps to fill out the Form 656 accurately

- Press the ‘Get Form’ button to obtain the form and open it in the selected document editor.

- Begin by filling out Section 1A (Your Information) for individual filers. Provide your first name, middle initial, last name, and Social Security number, alongside your spouse's information if a joint offer is requested. Include your physical home address and any mailing address if different.

- If you are filing for a business, complete Section 1B (Business Information) with your business name, address, Employer Identification Number, and primary contact details.

- In Section 2A (Tax Periods for Individual Tax Debt), list the appropriate tax years you are compromising. For business tax debt, complete Section 2B similarly.

- Provide a reason for your offer in Section 3. Indicate whether your offer is based on doubt as to collectibility or exceptional circumstances, and attach any necessary narrative or documentation.

- If applicable, check Box in Section 4 for Low-Income Certification, if your household income qualifies according to the provided chart, ensuring to follow further instructions related to payment requirements.

- In Section 5 (Payment Terms), indicate how you plan to pay the offer amount. Choose either a lump sum or periodic payment plan and provide the required payment details accordingly.

- Detail the source of funds for payment in Section 7, and ensure to follow the filing requirements and confirm all tax returns have been filed as required.

- Read and understand the terms outlined in Section 8, signing where necessary to agree, and prepare for IRS review.

- Finally, complete the signatures in Section 9, including signatures of both taxpayers if it is a joint offer. Make sure to provide the date of signing.

- Once the form is complete, you can save your changes, download, print, or share the form as needed for submission.

Start filling out the Form 656 online to take the first step towards settling your tax liabilities.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.