Loading

Get India Tata Aia Life Insurance Company Standing Instruction Form 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India Tata AIA Life Insurance Company Standing Instruction Form online

This guide provides step-by-step instructions for filling out the India Tata AIA Life Insurance Company Standing Instruction Form online. By following these detailed instructions, users can efficiently complete the form to facilitate premium payment instructions.

Follow the steps to fill out the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

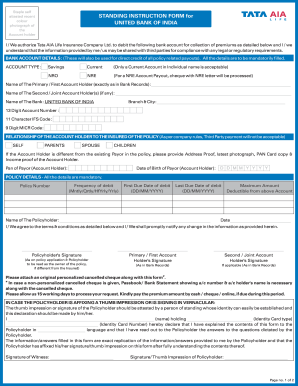

- Begin by providing your bank account details. Mandatory fields include the account type (Savings, Current, NRO, or NRE). Note that only a current account in an individual's name is acceptable.

- Enter the name of the primary account holder exactly as it appears in the bank records, and provide the name of any joint account holders if applicable.

- Fill in the bank name, branch, and city information.

- Input the 13-digit account number, 11-character IFS code, and the 9-digit MICR code.

- Indicate the relationship of the account holder to the insured policy using the provided options: Self, Parents, Spouse, or Children.

- If the account holder is different from the payor on the policy, you must attach the necessary documentation: Address Proof, a recent photograph, PAN Card copy, and income proof.

- Enter the date of birth of the payor (account holder) in the specified format.

- Include the PAN number of the payor for identification purposes.

- Fill in the policy details, including the policy number, frequency of debit, first due date, last due date, and the name of the policyholder.

- Specify the maximum amount that can be deducted from the bank account indicated.

- At the bottom of the form, ensure all required signatures are provided: Policyholder’s signature, primary account holder’s signature, and any joint account holder’s signature.

- Attach a personalized canceled cheque or provide a bank statement showing the account holder's name and account number if needed.

- Review all entered information for accuracy. Ensure all mandatory fields are completed.

- Once satisfied with your entries, save your changes, download the form for your records, or print it out. Follow up on where to send the completed form.

Complete your Tata AIA Life Insurance documents online for a smoother experience.

Disadvantages of Tata Life Insurance Value Income Plan: The lock-in period is 2 years for loan & surrender. The sum assured can't be changed post inception of the policy. The sum assured is too low. In case of death, the death benefit may not be sufficient to meet any of your future financial goals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.