Loading

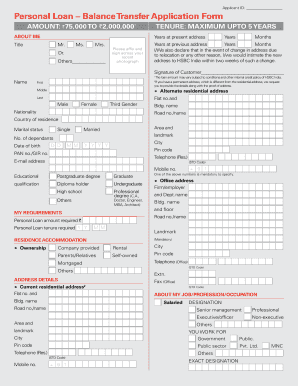

Get India Hsbc Personal Loan - Balance Transfer Application Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the India HSBC Personal Loan - Balance Transfer Application Form online

Filling out the India HSBC Personal Loan - Balance Transfer Application Form online can streamline your application process. This guide provides clear instructions on completing each section of the form accurately to ensure a smooth application experience.

Follow the steps to complete your application with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the 'About Me' section. Enter your name, title, and date of birth, ensuring all details are accurate. Provide your PAN number and email address as they are mandatory.

- In the 'My Requirements' section, specify the personal loan amount you require and the desired tenure for the loan, keeping in mind any maximum limits indicated.

- Complete the 'Residence Accommodation' section by selecting your type of accommodation (e.g., self-owned, rental) and filling in your current residential address details.

- Move to the 'About My Job/Profession' section. Indicate your employment status (salaried or self-employed), designation, and years in your current role. Include your firm's name and details.

- Fill out the 'Income Details' section with your annual salary or income details. Make sure to include any other annual income sources as applicable.

- In the 'Other Details' section, disclose any relationship with HSBC employees or directors as per the instructions provided.

- Review all information entered in the form for accuracy, and ensure compliance with any required documentation outlined in the first part of the application.

- Finally, once you have completed the form, save your changes and proceed to download, print, or share the application as needed.

Start completing your application for the India HSBC Personal Loan - Balance Transfer online today!

Related links form

Hence, one should take all the various fees and charges applicable into account while considering a personal loan transfer. To transfer a personal loan, your chosen bank will ask you to submit certain necessary documents, like salary slips, bank statements, identity proof, PAN card, address proof, etc.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.