Loading

Get Irs W-8exp 2017-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-8EXP online

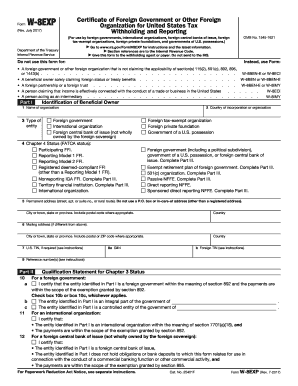

The IRS W-8EXP form is essential for foreign governments and organizations seeking exemption from U.S. tax withholding. This guide provides clear and supportive instructions on how to accurately complete this form online, ensuring compliance and smooth processing.

Follow the steps to correctly fill out the IRS W-8EXP.

- Click ‘Get Form’ button to obtain this essential document and open it in your preferred editor.

- In Part I, fill in the identification of the beneficial owner. Start by entering the name of the organization in the first field.

- Next, provide the country of incorporation or organization in the designated field.

- Select the type of entity by checking the appropriate box that describes your organization, such as foreign government or international organization.

- Complete the Chapter 4 Status (FATCA status) section by selecting the relevant status applicable to your entity.

- Enter the permanent address of the organization, ensuring to include street details, city, state, and postal code. Avoid using a P.O. Box.

- If the mailing address differs from the permanent address, fill in the mailing address section with the necessary details.

- In the following fields, provide the U.S. TIN if needed, the GIIN, the foreign TIN, and any reference numbers, as applicable.

- Proceed to Part II and complete the qualification statement for Chapter 3 Status, making sure to check the correct boxes that apply to your organization.

- Continue to Part III and fill out the qualification statement for Chapter 4 Status if required. Ensure accuracy in the information you provide.

- Finally, navigate to the Certification section. Sign, print your name, and date the form in the spaces provided to confirm the information is correct.

- After completing the form, you can save changes, download, print, or share the form as needed for submission.

Get started and fill out your IRS W-8EXP form online today.

Related links form

Form W-8BEN is used by foreign individuals who receive nonbusiness income in the U.S., whereas W-8BEN-E is used by foreign entities who receive this type of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.