Loading

Get Ca Edd De 9adj-i 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA EDD DE 9ADJ-I online

Completing the CA EDD DE 9ADJ-I form is essential for making adjustments to your quarterly contribution and wage reports. This guide provides clear and concise instructions to help you fill out the form accurately, ensuring your submissions meet all regulatory requirements.

Follow the steps to complete the CA EDD DE 9ADJ-I form.

- Press the ‘Get Form’ button to access the DE 9ADJ-I form, and open it in your preferred online editor.

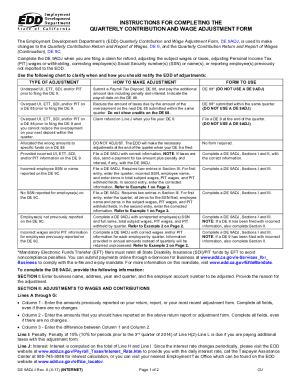

- In Section I, enter your business name, address, year and quarter, and the employer account number that requires adjustment. Clearly state the reason for the adjustment.

- Proceed to Section II, where you will report any adjustments to your wages and contributions. For Lines A through G, fill out the previously reported amounts in Column 1, the correct amounts in Column 2, and calculate the difference in Column 3.

- On Line I, include any penalties that apply, which is 15% of the additional tax due. Calculate interest on your total adjustments as outlined in the instructions.

- For Line K, note any erroneous State Disability Insurance deductions that have not been refunded. On Line L, enter your total contributions and withholdings paid.

- Calculate the total on Line M by adding Subtotal (Line H2), Penalty (Line I), and Interest (Line J) while accounting for any erroneous SDI deductions (Line K) and contributions paid (Line L).

- If necessary, complete Section III for adjustments to employee information previously reported on the DE 9C. Ensure to enter the correct details without negative amounts.

- After verifying the accuracy of all entries, remember to sign the form in the designated area, including your title, phone number, and date.

- Finally, proceed to save your changes, download, print, or share the completed form as needed.

Ensure your compliance and accuracy by completing the CA EDD DE 9ADJ-I online today.

The daily benefit amount is calculated by dividing your weekly benefit amount by seven. The maximum benefit amount is calculated by multiplying your weekly benefit amount by 52 or adding the total wages subject to State Disability Insurance (SDI) tax paid in your base period, whichever is less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.