Loading

Get Ny Db-150 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DB-150 online

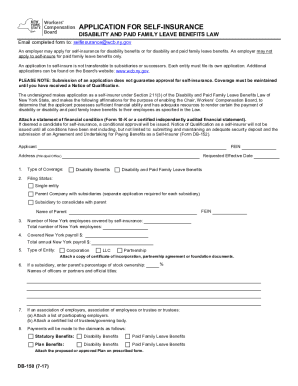

This guide provides clear, step-by-step instructions for completing the NY DB-150 application form for self-insurance under the Disability and Paid Family Leave Benefits Law. It is designed to assist users of all experience levels in accurately filling out the form online.

Follow the steps to complete your NY DB-150 application.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online editor.

- Begin by entering your Federal Employer Identification Number (FEIN) at the top of the form.

- Provide the applicant's name and address, specifying the principal office location.

- Select the type of coverage you are applying for - choose between disability benefits or disability and paid family leave benefits.

- Indicate your filing status by choosing one of the options: single entity, parent company with subsidiaries (noting that a separate application is needed for each subsidiary), or subsidiary to consolidate with a parent.

- List the number of New York employees who will be covered by self-insurance, along with the total number of New York employees.

- Enter the covered New York payroll amount and the total annual New York payroll amount.

- Select your type of entity (corporation, LLC, partnership) and attach the required documentation accordingly.

- If applicable, specify the parent's percentage of stock ownership if you are a subsidiary. List the names and official titles of your officers or partners.

- If you are applying as an association of employers or trustees, attach the necessary lists and certifications.

- Detail how payments will be made to claimants, specifying statutory and plan benefits for both disability and paid family leave.

- Indicate whether you intend to self-administer claims or utilize a claims administrator, providing their WCB license number along with contact information.

- Complete the section that requires authorizing individual's signature, name, title, date, and contact information.

- If applicable, include the corporate or partnership acknowledgment section, which will need to be notarized.

- Review all entries for accuracy and ensure that any required documentation is attached before finalizing.

- Once completed, save any changes, download the form, print it, or share it as needed.

Complete your NY DB-150 application online today for self-insurance benefits.

The amount you will receive is based on your average weekly wage from the previous year. To determine the amount of your benefits, your percentage of disability will be multiplied by two-thirds of your average weekly wage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.