Loading

Get 56b Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

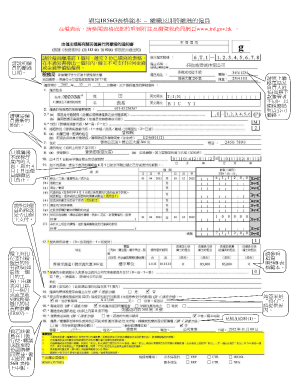

How to fill out the 56b form online

Filling out the 56b form can seem daunting, but with the right guidance, you can complete it efficiently online. This guide provides clear, step-by-step instructions tailored to your needs.

Follow the steps to successfully complete the 56b form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Provide the employee's departure date clearly in the specified field. Ensure the format is standard and adequately fills the specified characters.

- Enter the contact phone number and the name of the responsible person if different from the signer, facilitating communications from the tax authority.

- Input the employee's latest address for records. Ensure accuracy to prevent any issues with correspondence.

- Fill in the date using numerals only, adhering to the guideline on the form that requests a specific format.

- Declare the total income received by the employee, including amounts paid by overseas companies. Do not forget to fill in section 13 as instructed.

- Report the employee's income before any deductions of mandatory provident fund contributions or approved retirement scheme payments. Do not list employer contributions.

- Include all income earned from shares, tips, vacation pay, and any additional funds known to the employer, excluding refunds for work-related expenses.

- Only report income for the tax year, specifically from April 1 until the employee's departure date.

- For any foreign currency income, convert it to Hong Kong dollars following the day’s exchange rate guidelines provided.

- Indicate if the employer is responsible for withholding any part of the payments made, including the last month’s salary, from the time of submission for one month or until the consent release from the tax authority is received.

- Finally, review the entire form for accuracy before saving changes, downloading, printing, or sharing it as necessary.

Complete your documents online today and ensure accurate submission.

In the case of a deceased taxpayer, a form 56, “Notice Concerning Fiduciary Relationship,” should be filed by the executor, personal representative or administrator if one has been appointed and is responsible for disposition of the matter under consideration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.