Loading

Get Fatca/crs Entity Self-certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FATCA/CRS Entity Self-Certification Form online

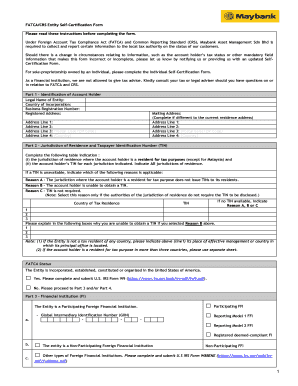

The FATCA/CRS Entity Self-Certification Form is essential for reporting information under the Foreign Account Tax Compliance Act and Common Reporting Standard. This guide provides a step-by-step approach to filling out the form online, ensuring you understand each section and its requirements.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred digital format.

- In Part 1, provide the identification information of the account holder. Fill in the legal name of the entity, country of incorporation, business registration number, registered address, and mailing address if it differs from the registered address.

- Proceed to Part 2 and complete the jurisdiction of residence and taxpayer identification number (TIN) section. Indicate the country of tax residence and fill in the TIN or provide a reason if a TIN is unavailable.

- In Part 3, identify the status of the entity as a financial institution. Check the appropriate boxes and provide the Global Intermediary Identification Number (GIIN) if applicable.

- In Part 4, determine if the entity qualifies as a non-financial entity. Select the relevant category such as an active business, charity, or other specified classifications.

- For Part 5, list the names of all controlling persons associated with the account holder.

- Complete the declaration and signature section, confirming the accuracy of the information. Include signatures, names, dates, and capacities where necessary.

- Review the form for completeness. Once satisfied, you can save changes, download, print, or share the form as needed.

Start completing your FATCA/CRS Entity Self-Certification Form online today!

Many employers have their own self-certification forms. If your employer doesn't have its own form you can download the Self Certification Form. Please print it, fill it in and hand it in to your employer. You do not need to see a Doctor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.