Loading

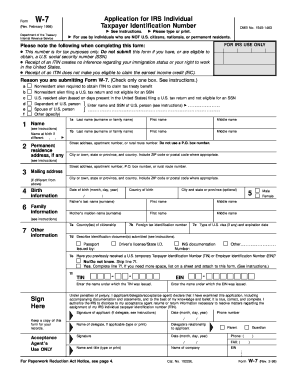

Get Form W-7 (rev. June 1996). Application For Irs Individual Taxpayer Identification Number - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-7 (Rev. June 1996). Application for IRS Individual Taxpayer Identification Number online

Filling out Form W-7 is an essential step for individuals who need an IRS Individual Taxpayer Identification Number (ITIN). This guide provides a clear and comprehensive overview of how to complete the form accurately, ensuring users can navigate the process with confidence.

Follow the steps to fill out Form W-7 accurately and efficiently.

- Press the ‘Get Form’ button to obtain the form and access it in your document editor.

- Identify the reason you are submitting Form W-7. Choose only one option from the listed categories, such as nonresident alien required to obtain ITIN or spouse of U.S. person.

- Enter your legal name in the fields provided, including surname, first name, and middle name. If your name has changed since birth, include your name at birth in the designated area.

- Provide your permanent residence address including street address, city or town, state or province, and country. Ensure you do not use a P.O. box.

- If different from your permanent address, provide your mailing address. This is where the IRS will send notifications regarding your ITIN.

- Enter your date of birth and country of birth accurately in the provided fields.

- Fill in your citizenship information and any foreign tax identification number you may hold.

- Describe the identification document(s) you are submitting for verification purposes, ensuring at least one document includes your photograph.

- If you have previously received a temporary Taxpayer Identification Number (TIN) or Employer Identification Number (EIN), indicate so and provide those numbers.

- Sign and date the form at the designated area. If applicable, include the name and relationship of any delegate signing on your behalf.

- Once all sections are complete, save your changes, and then download, print, or share the completed form as needed.

Complete your Form W-7 online today to ensure timely processing of your ITIN application.

Related links form

You can't get an ITIN number online, but you can apply for one by mail or directly at the IRS taxpayer assistance center.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.