Loading

Get St 103

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 103 online

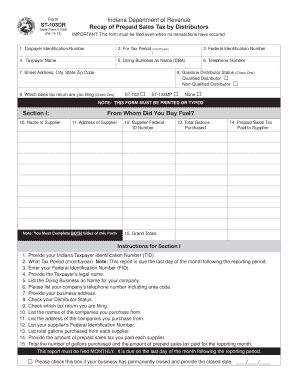

Filling out the St 103 form online can streamline your reporting process for prepaid sales tax by distributors. This guide offers step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete your St 103 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your Indiana Taxpayer Identification Number in the specified field.

- Specify the tax period by indicating the month and year for which you are reporting.

- Input your Federal Identification Number in the provided space.

- Type your legal name as the taxpayer in the designated field.

- If applicable, enter your Doing Business as (DBA) name.

- Provide your telephone number, ensuring to include the area code.

- Input your complete street address, city, state, and zip code.

- Select your distributor status by checking either 'Qualified Distributor' or 'Non-Qualified Distributor'.

- Indicate which sales tax return you are filing by checking the appropriate box.

- In Section I, list the name of each supplier from whom you purchased fuel.

- Provide the address of each supplier.

- Enter the supplier's Federal Identification Number.

- List the total gallons of fuel purchased from each supplier.

- Input the amount of prepaid sales tax paid to each supplier.

- Total the gallons purchased and the prepaid sales tax paid, then record this in the 'Grand Totals' section.

- In Section II, provide the name of each customer to whom you sold fuel.

- Enter each customer's address.

- List the Federal Identification Number for each customer.

- Record the total gallons of gasoline sold to each customer.

- Input the total tax-exempt gallons sold.

- Document the total prepaid sales tax collected from each customer.

- Sum all amounts in the columns and provide total gallonage and collected amounts in the final area.

- After filling out the form, ensure all details are correct before saving, downloading, printing, or sharing the completed document as needed.

Complete your St 103 form online to ensure timely and accurate reporting.

Contact the Indiana Department of Revenue at (317) 233-4015 with specific tax exemption questions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.