Loading

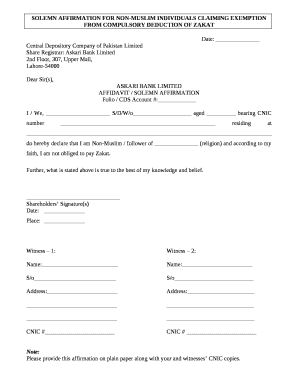

Get Solemn Affirmation For Non-muslim Individuals Claiming Exemption From Compulsory Deduction Of Zakat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SOLEMN AFFIRMATION FOR NON-MUSLIM INDIVIDUALS CLAIMING EXEMPTION FROM COMPULSORY DEDUCTION OF ZAKAT online

Filling out the Solemn Affirmation for Non-Muslim Individuals Claiming Exemption from Compulsory Deduction of Zakat is an important process for individuals who are not obligated to pay Zakat according to their faith. This guide provides clear, step-by-step instructions on how to complete the form online efficiently.

Follow the steps to successfully complete the affirmation form online.

- Click the ‘Get Form’ button to access the document template and open it in your preferred editor.

- In the section labeled 'Date', insert the current date when filling out the form.

- Enter the details of the Central Depository Company of Pakistan Limited, specifically the address provided in the document.

- Provide your Folio or CDS Account number in the designated field to identify your account.

- Complete the declaration statement by filling in your name, spouse's name (if applicable), age, bearing your CNIC number, and your place of residence.

- Clearly state your religious identity by filling in the name of your faith indicating that you are a Non-Muslim.

- At the bottom of the form, ensure that you sign the document to affirm that the information filled is accurate to the best of your knowledge.

- Include the names, relationships, addresses, and CNIC numbers of two witnesses in the specified fields. Make sure their information is accurate as this validates your declaration.

- After reviewing the completed form for accuracy, save your changes. You may download, print, or share the form as needed.

Prepare and complete your documents online to ensure a smooth affirmation process.

Is zakat due on funds? If it is an equities fund (primarily invests in stocks and shares), then yes. Your investment into an equity fund represents a proportionate ownership of all the companies in that fund. As such any zakatable assets held by the constituent companies will incur zakat.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.