Loading

Get Eftps Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Eftps Worksheet online

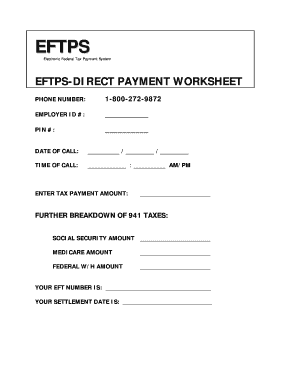

Completing the Eftps Worksheet online is a straightforward process that ensures your federal tax payments are accurately recorded. This guide will provide you with step-by-step instructions to fill out the necessary fields efficiently and correctly.

Follow the steps to complete your Eftps Worksheet online

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Enter your employer identification number (EIN) in the designated field, ensuring that it is entered correctly without any errors.

- Input your personal identification number (PIN) in the next available field. This number is essential for validating your identity within the system.

- Fill in the date of your call in the format: month/day/year, ensuring accuracy to prevent future complications.

- Record the time of your call in the corresponding field using the format of hours and minutes followed by AM or PM.

- Enter the total amount of your tax payment in the specified area, confirming the amount is correct.

- For a detailed breakdown of your federal taxes, include the amounts in the sections for Social Security, Medicare, and Federal withholding, ensuring each figure is precisely calculated.

- In the field labeled 'Your EFT number', provide the information needed to process your transaction.

- Lastly, input your settlement date in the designated field, formatted as month/day/year, to confirm when your payment will be processed.

- Once you have completed filling out all sections of the form, review your entries for accuracy. After confirming all information is correct, you may choose to save your changes, download, print, or share the form as needed.

Complete your Eftps Worksheet online today to ensure timely and accurate tax payments.

(updated July 13, 2023) EFTPS is used for most business payments. EFTPS may save you time if you are making quarterly estimated tax payments or making frequent payments. Direct Pay may be faster if you have an immediate payment deadline and have never used EFTPS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.