Loading

Get Mn Fi-00610-01 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN FI-00610-01 online

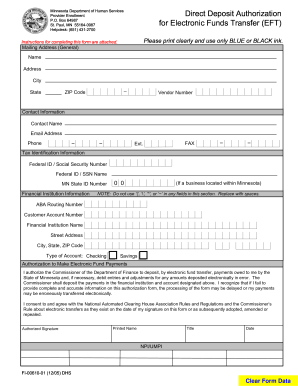

This guide provides step-by-step instructions on filling out the MN FI-00610-01 form online. By following these detailed directions, you will ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the MN FI-00610-01 form.

- Click the ‘Get Form’ button to retrieve the MN FI-00610-01 form and open it for editing.

- In the 'Tax Identification Information' section, enter your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) along with the name associated with it. Make sure to verify this number for accuracy.

- If you are a business located in Minnesota, input your MN State Identification Number in the designated field.

- In the 'Financial Institution Information' section, provide the ABA Routing Number of your bank. If you are unsure, please contact your financial institution for assistance.

- Next, enter your Customer Account Number as well as the name and complete address of the financial institution where funds will be deposited.

- Indicate whether the account is a checking or savings account by selecting the appropriate option.

- Proceed to authorize electronic fund payments by signing the form. Clearly print your name, title (if applicable), and date in the provided sections.

- Ensure you list any NPIs/UMPIs related to the payments that will be deposited into the specified account.

- Fill out the mailing address including your name, address, city, state, and zip code. If you have a vendor number, list it in the space provided.

- You may submit the completed form by mailing it to the Department of Human Services at the address provided, or you can fax it to the specified fax number.

- Lastly, ensure that the contact information is accurately completed. This should include the name, email address, phone number, and fax number of a person who can address any inquiries about the form.

Complete your MN FI-00610-01 form online today to ensure prompt processing of your direct deposit payments.

Yes, you can file your taxes electronically on your own, as plenty of options are available to assist you. Utilizing resources like uslegalforms helps simplify the process for the MN FI-00610-01 form, guiding you through the necessary steps. Filing electronically lets you manage your taxes efficiently, ensuring timely submission and direct communication with the tax authorities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.