Get Mn Mdh Fpc930 Class F 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN MDH FPC930 Class F online

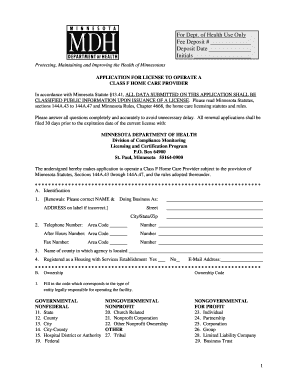

Filling out the MN MDH FPC930 Class F form is essential for those seeking to operate as a Class F home care provider in Minnesota. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out the MN MDH FPC930 Class F form.

- Click ‘Get Form’ button to retrieve the MN MDH FPC930 Class F form and open it in your preferred document editor.

- Begin with section A, Identification. Fill in your organization’s name, address, and contact details, ensuring accuracy to avoid processing delays.

- Proceed to section B, Ownership. Select the appropriate ownership code corresponding to your organization’s legal structure and provide the necessary legal entity information.

- In section C, Class F home care services offered, indicate the types of services provided and specify if they are delivered by your employees or through contracted providers.

- Complete section D, Other home care licenses, listing any additional licenses granted to your organization, including relevant addresses and license classes.

- Fill out section E, Employee information. Confirm if background checks have been conducted for individuals in direct contact with clients, alongside training requirements.

- Navigate to section F, Fees. Calculate your monthly average number of clients served over the past year to determine the appropriate licensing fee.

- Before submitting, complete section G, Verification, certifying that you have read the relevant Minnesota statutes and that the information provided is accurate.

- Once all sections are completed, review the form for accuracy, save your changes, and prepare to submit your application.

Complete your MN MDH FPC930 Class F application online today to ensure you meet the necessary licensing requirements.

Nonresidents who earn income from Minnesota sources must file a Minnesota nonresident tax return. This includes individuals who work or have rental property in Minnesota, which is vital for compliance with state law. The guidelines set forth align with the MN MDH FPC930 Class F standards, emphasizing proper tax reporting practices. Always ensure you gather all relevant documentation to file accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.