Loading

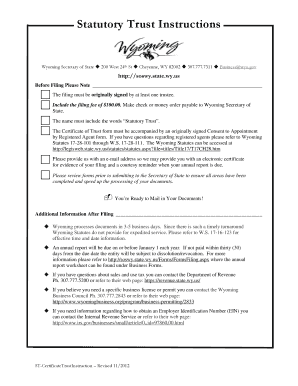

Get Wyoming Statutory Trust

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wyoming Statutory Trust online

Filling out the Wyoming Statutory Trust form online can seem daunting, but this guide will simplify the process for you. By following clear steps, you can efficiently complete the necessary information to establish your trust.

Follow the steps to fill out your Wyoming Statutory Trust online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin by entering the name of the statutory trust at the top of the form. Ensure that the name includes the words 'Statutory Trust' as required by Wyoming regulations.

- Next, provide the name and address of at least one trustee authorized to manage the statutory trust. Make sure to include accurate contact details.

- Fill in the name and physical address of the registered agent. This agent can be an individual resident in Wyoming or a business entity authorized to operate in Wyoming. Note that a Post Office Box is not acceptable.

- Complete the mailing address for the statutory trust. This should be distinct from the physical address of the registered agent.

- Enter the principal office address for the statutory trust. This is where the main activities of the trust will take place.

- If your certificate is not intended to be effective immediately upon filing, specify the future effective date or time in the designated section.

- Each trustee must sign the form in the execution section. Include the date of signature and print their names legibly.

- Provide a contact person’s name, daytime phone number, and email address to streamline communication regarding the trust.

- Review all filled sections carefully to ensure completeness. An incorrect or unfinished form may lead to processing delays.

- Once you have filled out the form, save your changes to keep a copy. You may also download, print, or share the form as necessary.

Get started on your Wyoming Statutory Trust by filling out the form online today.

Do Wyoming trusts pay tax? Wyoming is one of several states, like Florida and Texas, that has chosen not to impose a state income tax. Therefore, trusts are taxed the same way as all other assets owned by a Wyoming person or entity; income and capital gains taxes are paid at the federal level.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.