Loading

Get Payment Description Slip

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payment Description Slip online

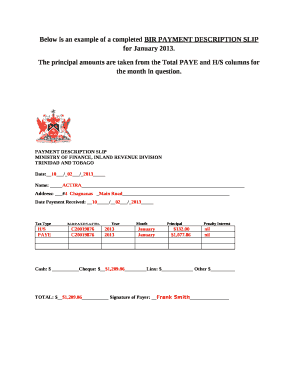

Filling out the Payment Description Slip online is a straightforward process that ensures accurate payment of taxes in Trinidad and Tobago. This guide provides step-by-step instructions to help users complete the form with ease.

Follow the steps to fill out the Payment Description Slip effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date in the format of day, month, and year. For instance, use 10/02/2013 for February 10, 2013.

- In the 'Name' field, input the full name of the individual or organization making the payment, ensuring accurate spelling for identity verification.

- In the 'Address' field, provide the complete address of the payer, including any necessary details like street number and name.

- Enter the 'Date Payment Received' in the same format used above, ensuring consistency.

- Indicate the type of tax being paid by checking off either 'H/S' or 'PAYE' in the 'Tax Type' section.

- Fill in your B.I.R/P.A.Y.E/V.A.T number, ensuring it's accurate to avoid discrepancies.

- Specify the year and month for which the payment applies. Ensure this matches with your tax records (e.g., Year: 2013, Month: January).

- Enter the principal amounts in the corresponding fields for 'Principal' payments, referencing total amounts calculated for the given month.

- If applicable, indicate any penalty interest in the designated field, using 'nil' if there are none.

- Choose the method of payment by filling out the cash, cheque, Linx, or other options. Ensure the total is accurately calculated and reflected.

- Finally, add your signature in the 'Signature of Payer' section, clearly representing the person responsible for the payment.

- Once all fields are completed, save the changes, and choose to download, print, or share your form as necessary.

Complete your Payment Description Slip online today for a seamless tax payment experience.

e-Tax is the online portal provided by the Inland Revenue Division (IRD) for taxpayers to manage their tax accounts online. By accessing e-Tax at https://etax.ird.gov.tt in any standard web browser,taxpayers can register to view their accounts, file returns, and correspond with IRD. e-Tax is safe, easy, and convenient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.